With on-the-go amusement and a vast variety of genres, mobile gaming has engulfed the lives of billions of people, offering something for every sort of player. Before consoles and PC, mobile gaming had the most revenue in 2022. Globally, there will be more than 2.2 billion mobile gamers in 2026, up from 1.75 billion in 2022. Revenues from the mobile gaming market are predicted to rise from 152.5 billion to 211.9 billion during the same time, reflecting the business’s expanding user base.

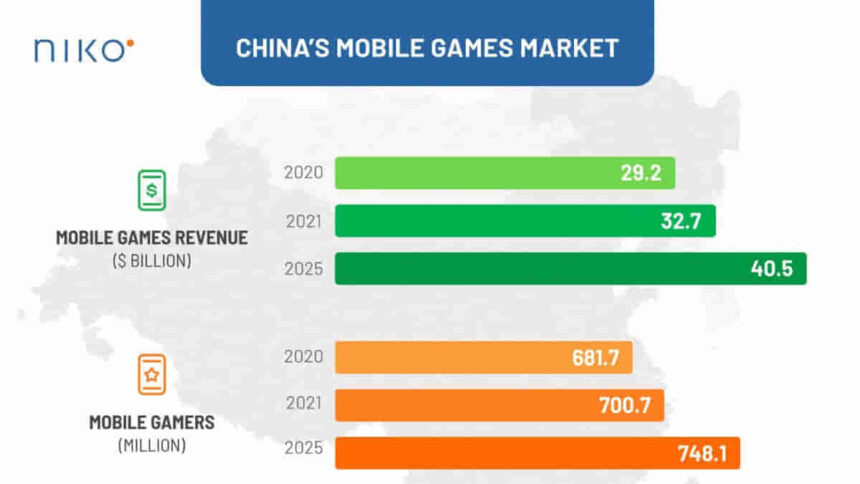

China is among the marketplaces for mobile gaming that is expanding the fastest, with around 660 million players. The Chinese mobile gaming market exceeded 209 billion yuan in 2019 and is expected to continue growing at a double-digit rate over the next few years thanks to cutting-edge technology like 5G and cloud services.

Domestic Market

China’s mobile gaming sector produced almost 70% of its revenue between 2015 and 2018, and it was predicted that this trend would continue until the year 2022. The percentage of sales revenue generated from mobile games increased to 68.5 percent in 2019 relative to China’s whole gaming sector. However, there was a 35-percentage point difference between 2017 and 2018 in the yearly growth rate of this market.

Overseas Context

The annual growth rate of China’s mobile game export market also fell during this time. By 2022, however, it is anticipated that the revenue from the international market will increase to around 80 billion yuan. Thus, by 2022, the revenue share of the overseas market would increase by almost three percent.

The Revenue and Growth of China’s Mobile

Compared to 2018, China’s mobile games business had an increase in annual revenue of 27.1% in 2019. The industry demonstrated a recovery following the poorest revenue growth rate in a year, probably because of China’s change to its game clearance regulations.

China’s mobile game export industry generated 42.12 billion yuan in revenue in 2018, which was more than a quarter of the market’s overall earnings. Outside of the home market, South and Southeast Asia are where Chinese mobile games are most popular. Compared to 2018, China’s mobile games business had an increase in annual revenue of 27.1% in 2019. The industry demonstrated a recovery following the poorest revenue growth rate in a year, probably because of China’s change to its game clearance regulations.

The annual growth rate of China’s mobile game export market also fell during this time. By 2022, however, it is anticipated that the revenue from the international market will increase to around 80 billion yuan. Thus, by 2022, the revenue share of the overseas market would increase by almost three percent.

The Booming Gaming Industry – China

The Chinese mobile gaming industry has grown rapidly over the past ten years and is expected to represent over 72% of China’s overall gaming revenue in 2022. The state’s online gaming crisis is to blame for the first fall in video game sales in ten years.

A Paradise of Mobile Games

The largest gaming market is found in the nation with the largest population. The majority of game players in the domestic market are from China, where more than half of the population plays mobile games. Compared to other markets, this gaming population is not only larger but also more active. Most Chinese mobile gamers played a minimum of once every day, with sessions typically lasting ten minutes. According to market predictions, users were also eager to spend money on games, as seen by an increase in Average Revenue Per User (ARPU).

Profitable but Difficult

International gaming behemoths frequently find it difficult to compete with local rivals in China because of the country’s rigorous restrictions and cultural gaming preferences. In this regard, Tencent continued to hold the top spot among Chinese publishers of mobile games. The entertainment tycoon’s gaming industry brought in almost 174 billion yuan in 2021. Global in-app sales for Tencent’s top-grossing mobile game Honour of Kings that year were roughly 2.2 billion dollars. The company had expanded into the mobile eSports market and swiftly gained a sizable market share.

At $US 46 billion in 2021, it was predicted that China would have the highest global video game revenue. Following tight play restrictions for those under the age of 18 and a freeze on new game license approvals by Chinese regulators, revenue growth decreased from 20.7% in 2020 to 6.4% in 2021.

“Get more sports news, cricket news, and football updates, log on to sportsdigest.in. Follow us on Facebook or Twitter and Subscribe to our YouTube Channel.”